The state of nature is uncertain. Geological variability at all scales and sparse sampling make resource uncertainty an inevitable reality for mining companies and the concerned public. The workflow for probabilistic resource estimation is established, providing accurate and precise estimates of uncertainty in local and global resources. An accurate assessment of resource uncertainty is powerful information. There are many ways to use this uncertainty for investment decisions, data acquisition and engineering design. It is natural to consider public disclosure of resource uncertainty. That would be a bad idea. The current regulatory environment in virtually every jurisdiction calls for classification of resources into measured, indicated and inferred. Our understanding of resource uncertainty should support the criteria for classification, but should not be directly disclosed.

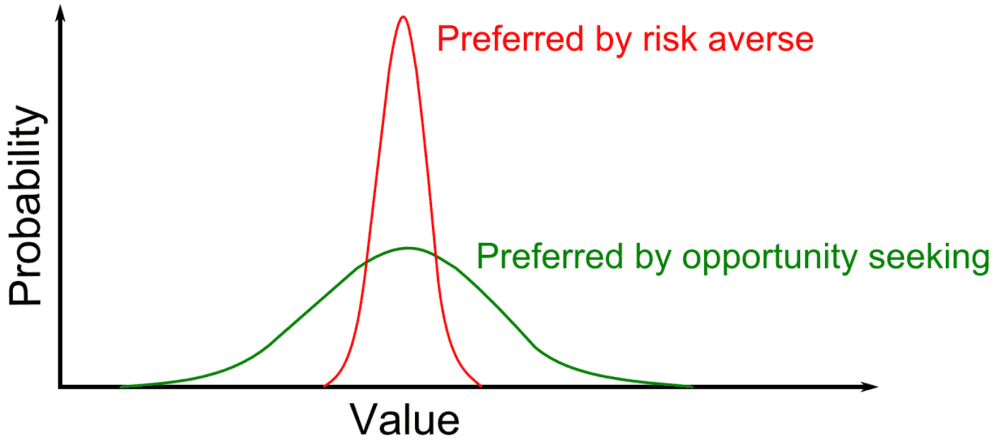

We are not advocating secrecy or withholding of information. We are advocating discretion and compliance with all formal and informal standards. The public disclosure of uncertainty is not required; classification is required. A company that discloses a range of resources could be at a disadvantage in the marketplace. Most people are naturally risk averse and would value an asset by the lowest number that is reported. For example, an expected resource of 1000 could be reported with a probability interval of 835 to 1165. The public would conservatively value the resource at 835. This would not be a concern if everyone is required to report the same probability interval. That is not the case and we should stick to classification.

The disclosure of petroleum resources is different than mineral resources. In Canada, NI 51-101 references the P10 and P90 quantiles as a measure of resource uncertainty. Also, in Canada, the result of an opinion poll is disclosed with the 95% probability interval, that is, the range that would include the true value 19 times out of 20. These are just two examples, but the public is not confused when uncertainty is disclosed by everyone in the same format.

There is no standard format for uncertainty reporting of mineral resources. Reporting some form of plus-minus range of values makes sense. Like petroleum resources, the P10 and P90 range would be a reasonable summary. The standard deviation or variance would be suitable for a statistician. The probability to be within 15% of the expected value is sometimes used. The advantage of this summary probability is that a range is not directly given; it is not easy to quickly identify and fixate on a low number. De facto and, perhaps, agreed upon standards may emerge in the mining industry as probabilistic resource estimation becomes more widely used.

It may be unfair to brand the public as risk averse. Arguably, many in the mining industry are opportunity seeking and interested in the upside potential. For example, consider two resources: deposit alpha with a resource of 1000 and an uncertainty range of 916 to 1084, and deposit beta with a resource of 1000 and a range of 835 to 1165. Everything else being equal, a risk averse member of the public would prefer deposit alpha because 916 is greater than 835. An opportunity seeking member of the public would prefer deposit beta because 1165 is greater than 1084. Disclosure of resource uncertainty would provide valuable information to all members of the public regardless of their position on risk. Risk aversion, however, seems more common.

Until uncertainty is reported as an industry wide standard, best practice will therefore construct probabilistic resource models to support classification decisions, provide input to planning and other technical decision-making including drill hole placement and spacing decisions. Probabilistic resources should be based on the best possible conceptual geological model and checked to the greatest extent possible. The possibility of bad estimates is mitigated by highly trained professionals, quality software and well documented best practices. Companies that adopt standard probabilistic resource modeling practices across assets have powerful information for risk-qualified asset management and consistent decisions.

Resource Modeling Solutions facilitates probabilistic resource estimation and uncertainty assessment. There is no single recipe for correct application in all circumstances, but the overall framework, software tools and workflows are emerging for accurate and precise estimates of resource uncertainty. We accept and respect the state of nature.